Page 167 - Demo

P. 167

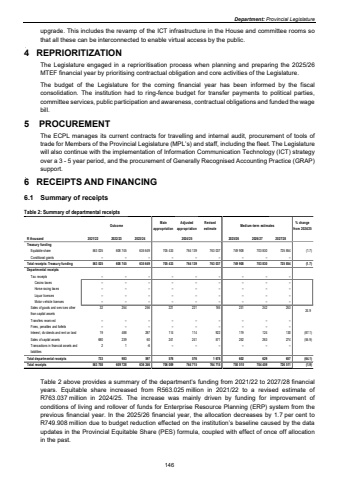

Department: Provincial Legislatureupgrade. This includes the revamp of the ICT infrastructure in the House and committee rooms so that all these can be interconnected to enable virtual access by the public. 4 REPRIORITIZATIONThe Legislature engaged in a reprioritisation process when planning and preparing the 2025/26 MTEF financial year by prioritising contractual obligation and core activities of the Legislature. The budget of the Legislature for the coming financial year has been informed by the fiscal consolidation. The institution had to ring-fence budget for transfer payments to political parties, committee services, public participation and awareness, contractual obligations and funded the wage bill. 5 PROCUREMENTThe ECPL manages its current contracts for travelling and internal audit, procurement of tools of trade for Members of the Provincial Legislature (MPL%u2019s) and staff, including the fleet. The Legislature will also continue with the implementation of Information Communication Technology (ICT) strategy over a 3 - 5 year period, and the procurement of Generally Recognised Accounting Practice (GRAP) support. 6 RECEIPTS AND FINANCING6.1 Summary of receipts Table 2: Summary of departmental receipts OutcomeMain appropriationAdjusted appropriationRevised estimateMedium-term estimates % change from 2024/25R thousand 2021/22 2022/23 2023/24 2025/26 2026/27 2027/28Treasury fundingEquitable share 563 025 608 745 635 649 705 433 764 139 763 037 749 908 703 830 725 854 (1.7)Conditional grants %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 Total receipts: Treasury funding 563 025 608 745 635 649 705 433 764 139 763 037 749 908 703 830 725 854 (1.7)Departmental receiptsTax receipts %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 Casino tax es %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 Horse racing tax es %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 Liquor licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 Motor v ehicle licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 Sales of goods and serv ices other than capital assets 254 32 256 221 221 185 231 242 253 24.9Transfers receiv ed %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Fines, penalties and forfeits %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Interest, div idends and rent on land 19 488 287 114 114 922 119 124 (87.1) 130Sales of capital assets 680 239 60 241 241 571 252 263 (55.9) 274Transactions in financial assets and liabilities 2 1 -6 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Total departmental receipts 733 983 597 576 576 1 678 602 629 (64.1) 657Total receipts 563 758 609 728 636 246 706 009 764 715 764 715 750 510 704 459 726 511 (1.9)2024/25 Table 2 above provides a summary of the department%u2019s funding from 2021/22 to 2027/28 financial years. Equitable share increased from R563.025 million in 2021/22 to a revised estimate of R763.037 million in 2024/25. The increase was mainly driven by funding for improvement of conditions of living and rollover of funds for Enterprise Resource Planning (ERP) system from the previous financial year. In the 2025/26 financial year, the allocation decreases by 1.7 per cent to R749.908 million due to budget reduction effected on the institution%u2019s baseline caused by the data updates in the Provincial Equitable Share (PES) formula, coupled with effect of once off allocation in the past. 146