Page 565 - Demo

P. 565

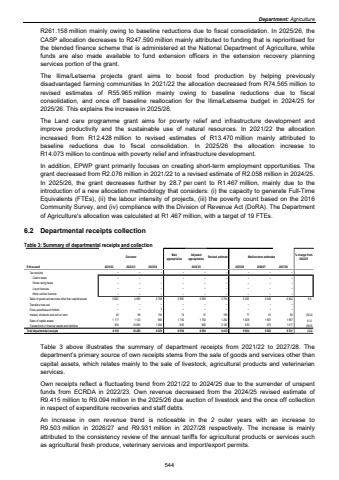

Department: AgricultureR261.158 million mainly owing to baseline reductions due to fiscal consolidation. In 2025/26, the CASP allocation decreases to R247.590 million mainly attributed to funding that is reprioritised for the blended finance scheme that is administered at the National Department of Agriculture, while funds are also made available to fund extension officers in the extension recovery planning services portion of the grant. The Ilima/Letsema projects grant aims to boost food production by helping previously disadvantaged farming communities In 2021/22 the allocation decreased from R74.565 million to revised estimates of R55.965 million mainly owing to baseline reductions due to fiscal consolidation, and once off baseline reallocation for the Ilima/Letsema budget in 2024/25 for 2025/26. This explains the increase in 2025/26. The Land care programme grant aims for poverty relief and infrastructure development and improve productivity and the sustainable use of natural resources. In 2021/22 the allocation increased from R12.428 million to revised estimates of R13.470 million mainly attributed to baseline reductions due to fiscal consolidation. In 2025/26 the allocation increase to R14.073 million to continue with poverty relief and infrastructure development. In addition, EPWP grant primarily focuses on creating short-term employment opportunities. The grant decreased from R2.076 million in 2021/22 to a revised estimate of R2.058 million in 2024/25. In 2025/26, the grant decreases further by 28.7 per cent to R1.467 million, mainly due to the introduction of a new allocation methodology that considers: (i) the capacity to generate Full-Time Equivalents (FTEs), (ii) the labour intensity of projects, (iii) the poverty count based on the 2016 Community Survey, and (iv) compliance with the Division of Revenue Act (DoRA). The Department of Agriculture's allocation was calculated at R1.467 million, with a target of 19 FTEs. 6.2 Departmental receipts collection Table 3: Summary of departmental receipts and collection Outcome Main appropriationAdjusted appropriation Revised estimate Medium-term estimates % change from 2024/25R thousand 2021/22 2022/23 2023/24 2025/26 2026/27 2027/28Tax receipts %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Casino taxes %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Horse racing taxes %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Liquor licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Motor vehicle licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Sales of goods and services other than capital assets 5 903 4 585 5 758 5 980 5 980 5 794 6 259 6 548 6 842 8.0Transfers received %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Fines, penalties and forfeits %u2013 %u2013 3 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Interest, dividends and rent on land 45 98 194 74 74 169 77 81 85 (54.4)Sales of capital assets 1 117 1 123 980 1 750 1 750 1 292 1 828 1 901 1 987 41.5Transactions in financial assets and liabilities 954 10 684 1 094 890 890 2 160 930 973 1 017 (56.9)Total departmental receipts 8 019 16 490 8 029 8 694 8 694 9 415 9 094 9 503 9 931 (3.4)2024/25 Table 3 above illustrates the summary of department receipts from 2021/22 to 2027/28. The department%u2019s primary source of own receipts stems from the sale of goods and services other than capital assets, which relates mainly to the sale of livestock, agricultural products and veterinarian services. Own receipts reflect a fluctuating trend from 2021/22 to 2024/25 due to the surrender of unspent funds from ECRDA in 2022/23. Own revenue decreased from the 2024/25 revised estimate of R9.415 million to R9.094 million in the 2025/26 due auction of livestock and the once off collection in respect of expenditure recoveries and staff debts. An increase in own revenue trend is noticeable in the 2 outer years with an increase to R9.503 million in 2026/27 and R9.931 million in 2027/28 respectively. The increase is mainly attributed to the consistency review of the annual tariffs for agricultural products or services such as agricultural fresh produce, veterinary services and import/export permits. 544