Page 321 - Demo

P. 321

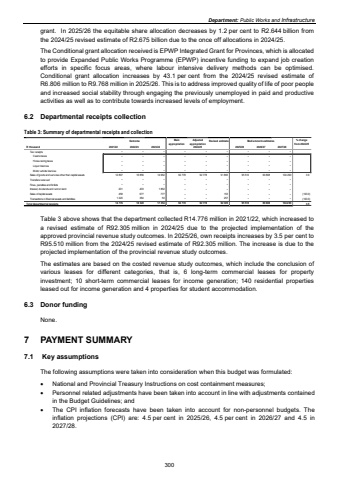

Department: Public Works and Infrastructuregrant. In 2025/26 the equitable share allocation decreases by 1.2 per cent to R2.644 billion from the 2024/25 revised estimate of R2.675 billion due to the once off allocations in 2024/25. The Conditional grant allocation received is EPWP Integrated Grant for Provinces, which is allocated to provide Expanded Public Works Programme (EPWP) incentive funding to expand job creation efforts in specific focus areas, where labour intensive delivery methods can be optimised. Conditional grant allocation increases by 43.1 per cent from the 2024/25 revised estimate of R6.806 million to R9.768 million in 2025/26. This is to address improved quality of life of poor people and increased social stability through engaging the previously unemployed in paid and productive activities as well as to contribute towards increased levels of employment. 6.2 Departmental receipts collection Table 3: Summary of departmental receipts and collection Outcome Main appropriationAdjusted appropriation Revised estimate Medium-term estimates % change from 2024/25R thousand 2021/22 2022/23 2023/24 2025/26 2026/27 2027/28Tax receipts %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Casino taxes %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Horse racing taxes %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Liquor licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Motor vehicle licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Sales of goods and services other than capital assets 12 897 16 856 14 662 92 778 92 778 91 895 95 510 99 808 104 299 3.9Transfers received %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Fines, penalties and forfeits %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Interest, dividends and rent on land 201 403 1 862 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Sales of capital assets 458 677 777 %u2013 %u2013 153 %u2013 %u2013 %u2013 (100.0)Transactions in financial assets and liabilities 1 220 384 53 %u2013 %u2013 257 %u2013 %u2013 %u2013 (100.0)Total departmental receipts 14 776 18 320 17 354 92 778 92 778 92 305 95 510 99 808 104 299 3.52024/25 Table 3 above shows that the department collected R14.776 million in 2021/22, which increased to a revised estimate of R92.305 million in 2024/25 due to the projected implementation of the approved provincial revenue study outcomes. In 2025/26, own receipts increases by 3.5 per cent to R95.510 million from the 2024/25 revised estimate of R92.305 million. The increase is due to the projected implementation of the provincial revenue study outcomes. The estimates are based on the costed revenue study outcomes, which include the conclusion of various leases for different categories, that is, 6 long-term commercial leases for property investment; 10 short-term commercial leases for income generation; 140 residential properties leased out for income generation and 4 properties for student accommodation. 6.3 Donor funding None. 7 PAYMENT SUMMARY 7.1 Key assumptions The following assumptions were taken into consideration when this budget was formulated: %uf0b7 National and Provincial Treasury Instructions on cost containment measures; %uf0b7 Personnel related adjustments have been taken into account in line with adjustments contained in the Budget Guidelines; and %uf0b7 The CPI inflation forecasts have been taken into account for non-personnel budgets. The inflation projections (CPI) are: 4.5 per cent in 2025/26, 4.5 per cent in 2026/27 and 4.5 in 2027/28.300