Page 644 - Demo

P. 644

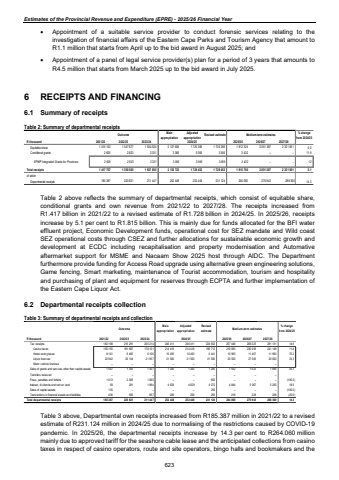

Estimates of the Provincial Revenue and Expenditure (EPRE) - 2025/26 Financial Year %uf0b7 Appointment of a suitable service provider to conduct forensic services relating to the investigation of financial affairs of the Eastern Cape Parks and Tourism Agency that amount to R1.1 million that starts from April up to the bid award in August 2025; and %uf0b7 Appointment of a panel of legal service provider(s) plan for a period of 3 years that amounts to R4.5 million that starts from March 2025 up to the bid award in July 2025. 6 RECEIPTS AND FINANCING 6.1 Summary of receipts Table 2: Summary of departmental receipts Outcome Main appropriationAdjusted appropriation Revised estimate Medium-term estimates % change from 2024/25R thousand 2021/22 2022/23 2023/24 2025/26 2026/27 2027/28Equitable share 1 347 677 1 415 152 1 934 524 2 127 656 1 725 386 1 725 386 1 812 324 2 051 387 2 321 561 5.0Conditional grants 2 823 2 605 3 331 3 066 3 066 3 066 3 432 %u2013 %u2013 11.9EPWP Integrated Grants for Provinces 2 605 2 823 3 331 3 066 3 066 3 066 3 432 %u2013 %u2013 12 Total receipts 1 350 500 1 417 757 1 937 855 2 130 722 1 728 452 1 728 452 1 815 756 2 051 387 2 321 561 5.1of whichDepartmental receipts 220 821 185 387 211 447 252 448 252 448 231 124 264 060 275 943 288 360 14.32024/25 Table 2 above reflects the summary of departmental receipts, which consist of equitable share, conditional grants and own revenue from 2021/22 to 2027/28. The receipts increased from R1.417 billion in 2021/22 to a revised estimate of R1.728 billion in 2024/25. In 2025/26, receipts increase by 5.1 per cent to R1.815 billion. This is mainly due for funds allocated for the BFI water effluent project, Economic Development funds, operational cost for SEZ mandate and Wild coast SEZ operational costs through CSEZ and further allocations for sustainable economic growth and development at ECDC including recapitalisation and property modernisation and Automative aftermarket support for MSME and Nacaam Show 2025 host through AIDC. The Department furthermore provide funding for Access Road upgrade using alternative green engineering solutions, Game fencing, Smart marketing, maintenance of Tourist accommodation, tourism and hospitality and purchasing of plant and equipment for reserves through ECPTA and further implementation of the Eastern Cape Liquor Act. 6.2 Departmental receipts collection Table 3: Summary of departmental receipts and collection Outcome Main appropriationAdjusted appropriationRevised estimate Medium-term estimates % change from 2024/25R thousand 2021/22 2022/23 2023/24 2025/26 2026/27 2027/28Tax receipts 182 198 216 291 206 214 246 411 246 411 224 653 257 446 269 025 281 131 14.6Casino tax es 150 155 181 687 178 101 214 418 214 418 196 712 219 983 230 058 241 148 11.8Horse racing tax es 9 101 8 460 6 156 10 493 10 493 6 441 10 963 11 467 11 983 70.2Liquor licences 22 942 26 144 21 957 21 500 21 500 21 500 26 500 27 500 28 000 23.3Motor v ehicle licences %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Sales of goods and serv ices other than capital assets 1 547 1 355 1 307 1 200 1 200 1 200 1 552 1 623 1 696 29.3Transfers receiv ed %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013 %u2013Fines, penalties and forfeits 1 013 2 385 1 085 %u2013 %u2013 650 %u2013 %u2013 (100.0) %u2013Interest, div idends and rent on land 58 281 1 984 4 628 4 628 4 072 4 844 5 067 5 295 18.9Sales of capital assets 135 %u2013 %u2013 %u2013 %u2013 256 %u2013 %u2013 (100.0) %u2013Transactions in financial assets and liabilities 436 509 857 209 209 293 218 228 (25.6) 238Total departmental receipts 185 387 220 821 211 447 252 448 252 448 231 124 264 060 275 943 288 360 14.32024/25 Table 3 above, Departmental own receipts increased from R185.387 million in 2021/22 to a revised estimate of R231.124 million in 2024/25 due to normalising of the restrictions caused by COVID-19 pandemic. In 2025/26, the departmental receipts increase by 14.3 per cent to R264.060 million mainly due to approved tariff for the seashore cable lease and the anticipated collections from casino taxes in respect of casino operators, route and site operators, bingo halls and bookmakers and the 623