Page 460 - Provincial Treasury Estimates.pdf

P. 460

Department: Rural Development and Agrarian Reform

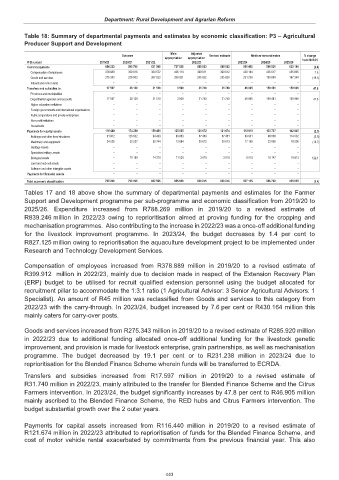

Table 18: Summary of departmental payments and estimates by economic classification: P3 – Agricultural

Producer Support and Development

Main Adjusted

Outcome Revised estimate Medium-term estimates % change

appropriation appropriation from 2022/23

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Current payments 654 232 596 799 631 595 727 035 685 833 685 832 661 402 596 521 623 184 (3.6)

Compensation of employees 378 889 359 816 364 572 436 114 399 911 399 912 430 164 436 617 455 835 7.6

Goods and services 275 343 236 983 267 023 290 921 285 922 285 920 231 238 159 904 167 349 (19.1)

Interest and rent on land – – – – – – – – –

Transfers and subsidies to: 17 597 28 129 31 510 3 509 31 740 31 740 46 905 159 481 159 906 47.8

Provinces and municipalities – – – – – – – – –

Departmental agencies and accounts 17 597 28 129 31 510 3 509 31 740 31 740 46 905 159 481 159 906 47.8

Higher education institutions – – – – – – – – –

Foreign governments and international organisations – – – – – – – – –

Public corporations and private enterprises – – – – – – – – –

Non-profit institutions – – – – – – – – –

Households – – – – – – – – –

Payments for capital assets 116 440 174 268 159 461 125 085 121 672 121 674 118 818 130 707 142 845 (2.3)

Buildings and other fixed structures 91 912 126 632 94 439 99 863 97 450 97 451 93 631 98 500 114 032 (3.9)

Machinery and equipment 24 528 32 527 50 744 13 684 20 612 20 613 17 169 22 060 18 200 (16.7)

Heritage Assets – – – – – – – – –

Specialised military assets – – – – – – – – –

Biological assets – 15 109 14 278 11 538 3 610 3 610 8 018 10 147 10 613 122.1

Land and sub-soil assets – – – – – – – – –

Software and other intangible assets – – – – – – – – –

Payments for financial assets – – – – – – – – –

Total economic classification 788 269 799 196 822 566 855 629 839 245 839 246 827 125 886 709 925 935 (1.4)

Tables 17 and 18 above show the summary of departmental payments and estimates for the Farmer

Support and Development programme per sub-programme and economic classification from 2019/20 to

2025/26. Expenditure increased from R788.269 million in 2019/20 to a revised estimate of

R839.246 million in 2022/23 owing to reprioritisation aimed at proving funding for the cropping and

mechanisation programmes. Also contributing to the increase in 2022/23 was a once-off additional funding

for the livestock improvement programme. In 2023/24, the budget decreases by 1.4 per cent to

R827.125 million owing to reprioritisation the aquaculture development project to be implemented under

Research and Technology Development Services.

Compensation of employees increased from R378.889 million in 2019/20 to a revised estimate of

R399.912 million in 2022/23, mainly due to decision made in respect of the Extension Recovery Plan

(ERP) budget to be utilised for recruit qualified extension personnel using the budget allocated for

recruitment pillar to accommodate the 1:3:1 ratio (1 Agricultural Advisor: 3 Senior Agricultural Advisors: 1

Specialist). An amount of R45 million was reclassified from Goods and services to this category from

2022/23 with the carry-through. In 2023/24, budget increased by 7.6 per cent or R430.164 million this

mainly caters for carry-over posts.

Goods and services increased from R275.343 million in 2019/20 to a revised estimate of R285.920 million

in 2022/23 due to additional funding allocated once-off additional funding for the livestock genetic

improvement, and provision is made for livestock enterprise, grain partnerships, as well as mechanisation

programme. The budget decreased by 19.1 per cent or to R231.238 million in 2023/24 due to

reprioritisation for the Blended Finance Scheme wherein funds will be transferred to ECRDA.

Transfers and subsidies increased from R17.597 million in 2019/20 to a revised estimate of

R31.740 million in 2022/23, mainly attributed to the transfer for Blended Finance Scheme and the Citrus

Farmers intervention. In 2023/24, the budget significantly increases by 47.8 per cent to R46.905 million

mainly ascribed to the Blended Finance Scheme, the RED hubs and Citrus Farmers intervention. The

budget substantial growth over the 2 outer years.

Payments for capital assets increased from R116.440 million in 2019/20 to a revised estimate of

R121.674 million in 2022/23 attributed to reprioritisation of funds for the Blended Finance Scheme, and

cost of motor vehicle rental exacerbated by commitments from the previous financial year. This also

443