Page 466 - Provincial Treasury Estimates.pdf

P. 466

Department: Rural Development and Agrarian Reform

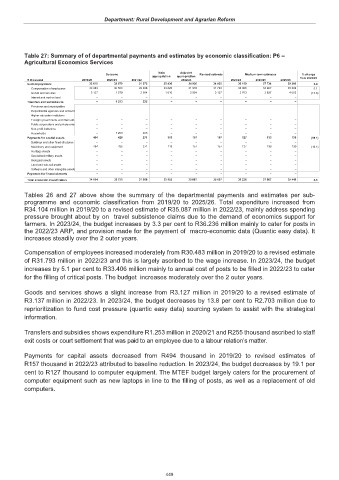

Table 27: Summary of of departmental payments and estimates by economic classification: P6 –

Agricultural Economics Services

Main Adjusted

Outcome Revised estimate Medium-term estimates % change

appropriation appropriation from 2022/23

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Current payments 33 610 32 079 31 372 35 436 34 930 34 930 36 109 37 734 39 309 3.4

Compensation of employees 30 483 30 500 29 368 33 826 31 976 31 793 33 406 33 907 35 306 5.1

Goods and services 3 127 1 579 2 004 1 610 2 954 3 137 2 703 3 827 4 003 (13.8)

Interest and rent on land – – – – – – – – –

Transfers and subsidies to: – 1 253 225 – – – – – –

Provinces and municipalities – – – – – – – – –

Departmental agencies and accounts – – – – – – – – –

Higher education institutions – – – – – – – – –

Foreign governments and internation – – – – – – – – –

Public corporations and private ente – – – – – – – – –

Non-profit institutions – – – – – – – – –

Households – 1 253 225 – – – – – –

Payments for capital assets 494 426 271 119 157 157 127 133 139 (19.1)

Buildings and other fixed structures – – – – – – – – –

Machinery and equipment 494 426 271 119 157 157 127 133 139 (19.1)

Heritage Assets – – – – – – – – –

Specialised military assets – – – – – – – – –

Biological assets – – – – – – – – –

Land and sub-soil assets – – – – – – – – –

Software and other intangible assets – – – – – – – – –

Payments for financial assets – – – – – – – – –

Total economic classification 34 104 33 758 31 868 35 555 35 087 35 087 36 236 37 867 39 448 3.3

Tables 26 and 27 above show the summary of the departmental payments and estimates per sub-

programme and economic classification from 2019/20 to 2025/26. Total expenditure increased from

R34.104 million in 2019/20 to a revised estimate of R35.087 million in 2022/23, mainly address spending

pressure brought about by on travel subsistence claims due to the demand of economics support for

farmers. In 2023/24, the budget increases by 3.3 per cent to R36.236 million mainly to cater for posts in

the 2022/23 ARP, and provision made for the payment of macro-economic data (Quantic easy data). It

increases steadily over the 2 outer years.

Compensation of employees increased moderately from R30.483 million in 2019/20 to a revised estimate

of R31.793 million in 2022/23 and this is largely ascribed to the wage increase. In 2023/24, the budget

increases by 5.1 per cent to R33.406 million mainly to annual cost of posts to be filled in 2022/23 to cater

for the filling of critical posts. The budget increases moderately over the 2 outer years.

Goods and services shows a slight increase from R3.127 million in 2019/20 to a revised estimate of

R3.137 million in 2022/23. In 2023/24, the budget decreases by 13.8 per cent to R2.703 million due to

reprioritization to fund cost pressure (quantic easy data) sourcing system to assist with the strategical

information.

Transfers and subsidies shows expenditure R1.253 million in 2020/21 and R255 thousand ascribed to staff

exit costs or court settlement that was paid to an employee due to a labour relation’s matter.

Payments for capital assets decreased from R494 thousand in 2019/20 to revised estimates of

R157 thousand in 2022/23 attributed to baseline reduction. In 2023/24, the budget decreases by 19.1 per

cent to R127 thousand to computer equipment. The MTEF budget largely caters for the procurement of

computer equipment such as new laptops in line to the filling of posts, as well as a replacement of old

computers.

449