Page 42 - Demo

P. 42

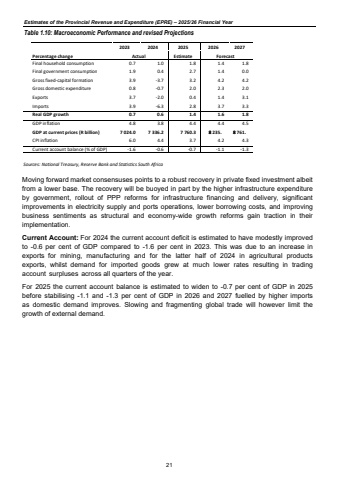

Estimates of the Provincial Revenue and Expenditure (EPRE) %u2013 2025/26 Financial YearTable 1.10: Macroeconomic Performance and revised Projections 21Percentage change2023 2024 2025 2026 2027 Actual Estimate Forecast0.7 1.0 1.8 1.4 1.8 1.9 0.4 2.7 1.4 0.0 3.9 -3.7 3.2 4.2 4.2 0.8 -0.7 2.0 2.3 2.0 3.7 -2.0 0.4 1.4 3.1 Final household consumptionFinal government consumptionGross fixed-capital formationGross domestic expenditureExportsImports 3.9 -6.3 2.8 3.7 3.3 Real GDP growth 0.7 0.6 1.4 1.6 1.8 4.8 3.8 4.4 4.4 4.5 7 024.0 7 336.2 7 760.3 8 235. 8 761.GDP inflationGDP at current prices (R billion)CPI inflation 6.0 4.4 3.7 4.2 4.3 Current account balance (% of GDP) -1.6 -0.6 -0.7 -1.1 -1.3Sources: National Treasury, Reserve Bank and Statistics South AfricaMoving forward market consensuses points to a robust recovery in private fixed investment albeit from a lower base. The recovery will be buoyed in part by the higher infrastructure expenditure by government, rollout of PPP reforms for infrastructure financing and delivery, significant improvements in electricity supply and ports operations, lower borrowing costs, and improving business sentiments as structural and economy-wide growth reforms gain traction in their implementation. Current Account: For 2024 the current account deficit is estimated to have modestly improved to -0.6 per cent of GDP compared to -1.6 per cent in 2023. This was due to an increase in exports for mining, manufacturing and for the latter half of 2024 in agricultural products exports, whilst demand for imported goods grew at much lower rates resulting in trading account surpluses across all quarters of the year. For 2025 the current account balance is estimated to widen to -0.7 per cent of GDP in 2025 before stabilising -1.1 and -1.3 per cent of GDP in 2026 and 2027 fuelled by higher imports as domestic demand improves. Slowing and fragmenting global trade will however limit the growth of external demand.