Page 596 - Provincial Treasury Estimates.pdf

P. 596

Department: +XPDQ 6HWWOHPHQWV

6. Receipts and financing

6.1 Summary of receipts

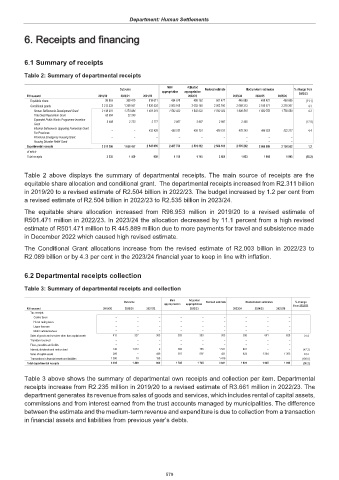

Table 2: Summary of departmental receipts

Main Adjusted

Outcome Revised estimate Medium-term estimates % change from

appropriation appropriation

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Equitable share 98 953 359 410 618 611 434 570 498 152 501 471 445 889 486 421 460 685 (11.1)

Conditional grants 2 212 333 1 299 047 1 926 424 2 003 160 2 003 160 2 003 160 2 089 313 2 180 577 2 278 267 4.3

Human Settlements Development Grant 2 148 931 1 274 084 1 491 219 1 542 022 1 542 022 1 542 022 1 608 515 1 680 752 1 756 050 4.3

Title Deed Restoration Grant 60 904 22 240 – – –

Expanded Public Works Programme Incentive 2 498 2 723 2 777 2 987 2 987 2 987 2 455 – – (17.8)

Grant

Informal Settlements Upgrading Parnership Grant – – 432 428 458 151 458 151 458 151 478 343 499 825 522 217 4.4

For Provinces

Provincial Emergency Housing Grant – – – – – – – – –

Housing Disaster Relief Grant – – –

Departmental receipts 2 311 286 1 658 457 2 545 035 2 437 730 2 501 312 2 504 631 2 535 202 2 666 998 2 738 952 1.2

of which

Total receipts 2 235 1 409 909 1 745 1 745 3 661 1 823 1 905 1 993 (50.2)

Table 2 above displays the summary of departmental receipts. The main source of receipts are the

equitable share allocation and conditional grant. The departmental receipts increased from R2.311 billion

in 2019/20 to a revised estimate of R2.504 billion in 2022/23. The budget increased by 1.2 per cent from

a revised estimate of R2.504 billion in 2022/23 to R2.535 billion in 2023/24.

The equitable share allocation increased from R98.953 million in 2019/20 to a revised estimate of

R501.471 million in 2022/23. In 2023/24 the allocation decreased by 11.1 percent from a high revised

estimate of R501.471 million to R 445.889 million due to more payments for travel and subsistence made

in December 2022 which caused high revised estimate.

The Conditional Grant allocations increase from the revised estimate of R2.003 billion in 2022/23 to

R2.089 billion or by 4.3 per cent in the 2023/24 financial year to keep in line with inflation.

6.2 Departmental receipts collection

Table 3: Summary of departmental receipts and collection

Main Adjusted

Outcome Revised estimate Medium-term estimates % change

appropriation appropriation

from 2022/23

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Tax receipts – – – – – – – – –

Casino taxes – – – – – – – – –

Horse racing taxes – – – – – – – – –

Liquor licences – – – – – – – – –

Motor vehicle licences – – – – – – – – –

Sales of goods and services other than capital assets 413 327 303 383 383 303 398 601 628 31.4

Transfers received – – – – – – – – –

Fines, penalties and forfeits – – – – – – – – –

Interest, dividends and rent on land 146 1 072 2 765 765 1 521 801 – – (47.3)

Sales of capital assets 286 – 446 597 597 421 624 1 304 1 365 48.2

Transactions in financial assets and liabilities 1 390 10 158 – – 1 416 – – – (100.0)

Total departmental receipts 2 235 1 409 909 1 745 1 745 3 661 1 823 1 905 1 993 (50.2)

Table 3 above shows the summary of departmental own receipts and collection per item. Departmental

receipts increase from R2.235 million in 2019/20 to a revised estimate of R3.661 million in 2022/23. The

department generates its revenue from sales of goods and services, which includes rental of capital assets,

commissions and from interest earned from the trust accounts managed by municipalities. The difference

between the estimate and the medium-term revenue and expenditure is due to collection from a transaction

in financial assets and liabilities from previous year’s debts.

579